After soaring more than 50% in the last 18 months, Indian stocks are finding it tough to keep the bull run going (blame it on investor fatigue or fate).

What’s worse? Arch emerging-markets rival China has been spraying stimulus at its economy like Leo tossing around cash in The Wolf of Wall Street to keep the party going.

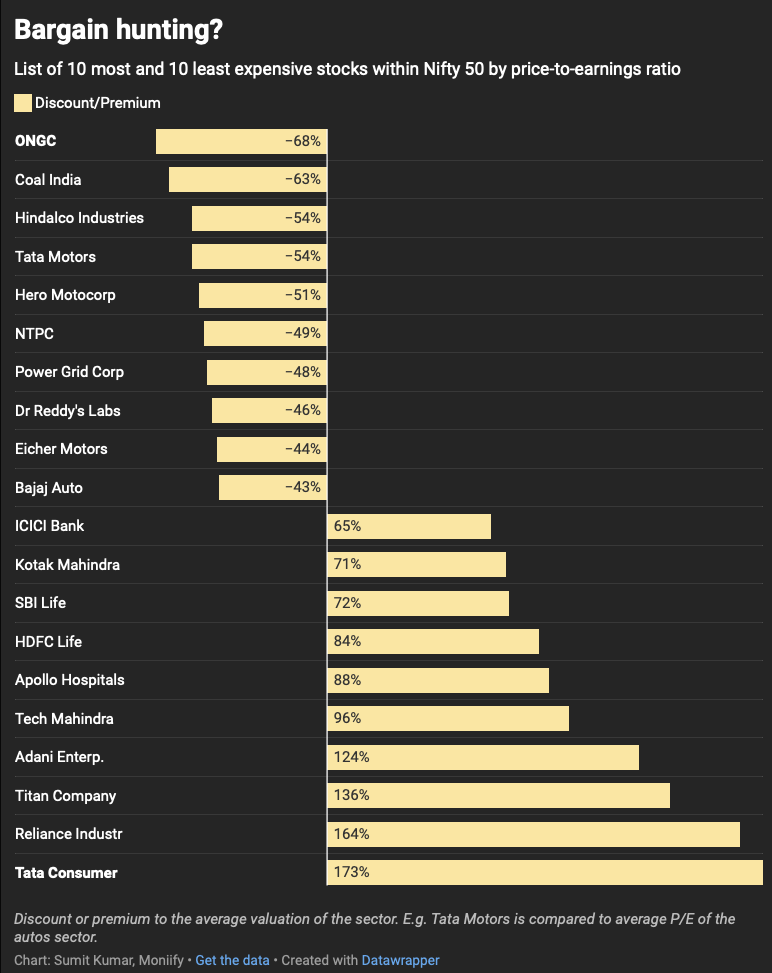

But there are some big-name stocks – like Tata Motors and Hero MotoCorp – trading at more than a 50% discount to their peers. (If you’re in the mood for a deal, there’s a shopping list for you waiting below.)

But before you get there, here are some India numbers to consider:

- Foreign investors are shifting their cash to undervalued Chinese stocks – they’ve yanked $7.59 billion out of Indian equity markets in just 15 days.

- The Nifty 50’s dropped 4% since China unleashed its stimulus “bazooka” on September 24.

- Over a third of the Nifty 50 is trading at a discount compared to the industry’s average price-to-earnings ratio.

Why India?

Sure, China’s throwing money around, but Xi’s revival plan isn’t going to work miracles overnight. It’ll take years. In the meantime, emerging markets like India are still looking pretty attractive.

The big picture for India? Stable. The country’s GDP growth is expected to hold steady through 2025, according to India’s central bank, the World Bank, and even Moody’s, all of whom have raised their forecasts.

Large caps with their steady corporate governance and big spending plans could be the engine behind this growth. That makes these undervalued giants ripe for the picking, as long as they don’t fumble the play with their corporate earnings.

And while foreign investors have been turning their gaze toward China, domestic investors haven’t hit pause – they’re still pumping cash into Indian markets. Domestic institutional investors stepped in to buy $6.96 billion worth of stocks between October 1 and 11, while foreign investors sold about $7.03 billion.

And there’s plenty more firepower: Indian mutual funds are sitting on a $22 billion war chest, ready to swoop in on undervalued stocks.

ChatGPT corner