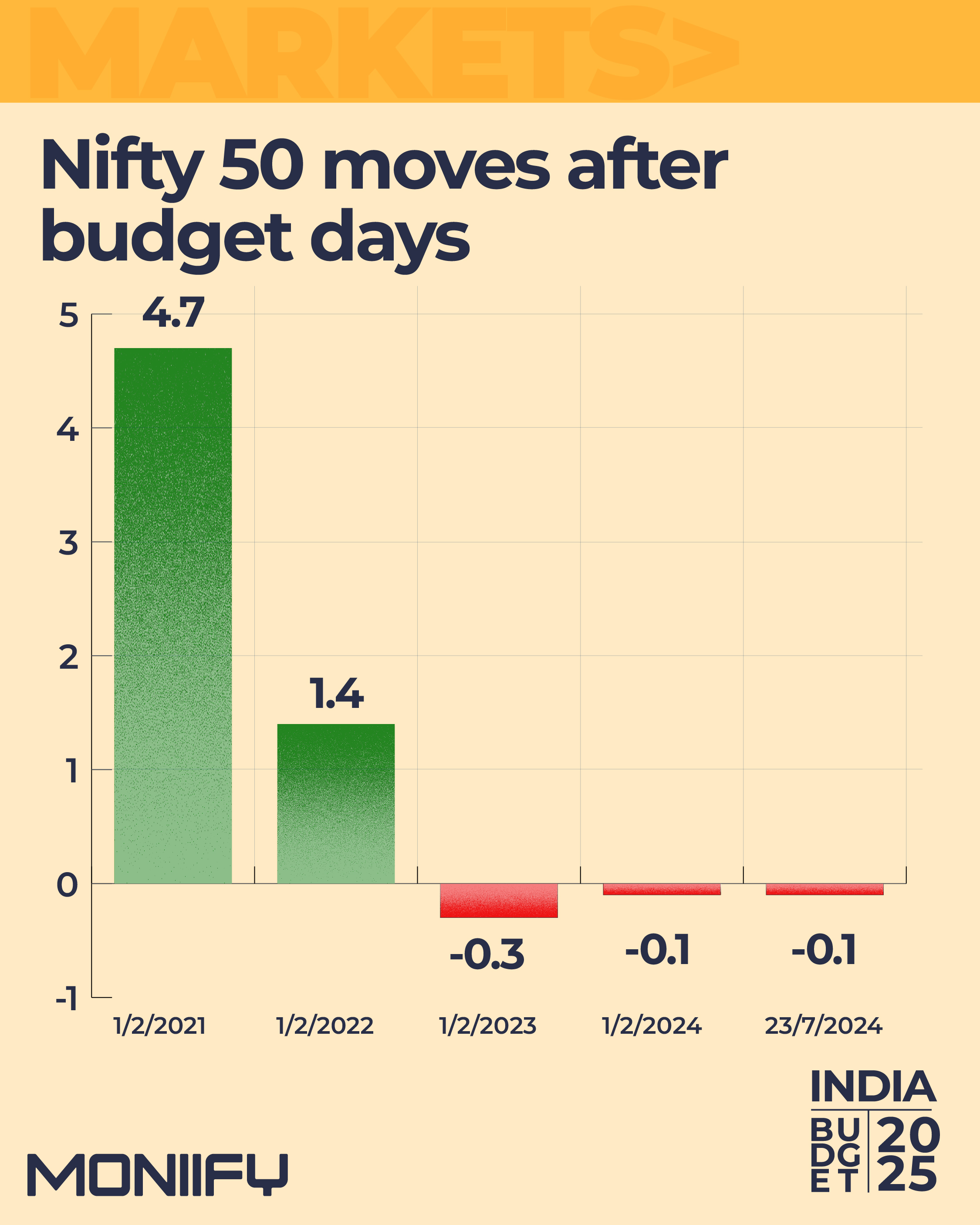

If you were hoping India’s budget will set the markets on fire, you might want to put down that extinguisher.

This one’s shaping to be a lukewarm cup of tea: mild, predictable, and unlikely to stir much excitement. Finance Minister Nirmala Sitharaman isn’t likely to pull out any rabbits. No big tax cuts, no stimulus bazooka — just business as usual.

Insert expectations vs. reality meme.

Sure, the Modi government could use this moment to revive market sentiment, but if history is any guide, it’ll pass.

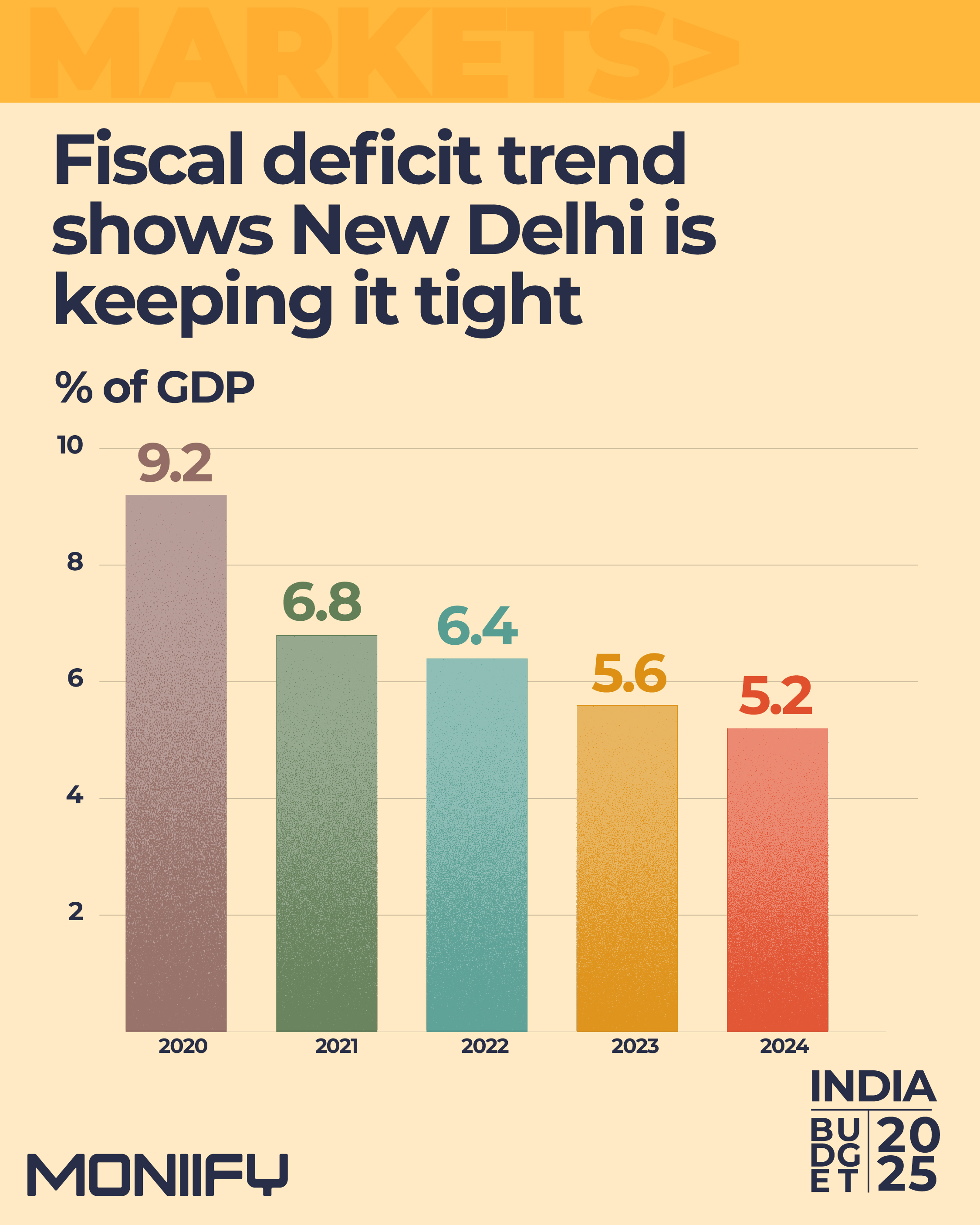

Unless there’s a crisis (see: COVID-19), Prime Minister Narendra Modi sticks to tight spending and avoids splashy moves. And with no major elections on the horizon (except New Delhi, which barely counts), don’t expect surprises.

The real mover?

If you were betting on a blockbuster budget rally, it might be wiser to shift focus to the Reserve Bank of India.

The central bank has already announced $18 billion in liquidity-boosting measures — a clear pivot from its recent inflation-fighting stance as concerns about slowing economic growth take centerstage.

Read more: Budget 2025 won’t fix India’s crypto problem — here’s why

And it could cut rates next week to combat slowing growth.

India’s GDP growth just dropped to 5.4%, the weakest since 2022. Loan growth is sluggish, consumer demand is weak, and corporate earnings are struggling. The stock market? Still correcting. The rupee? Still sliding.

Growth remains below its pre-pandemic trajectory, demand remains sluggish, and corporate investments have yet to show a decisive turnaround, according to Madhavi Arora and Harshal Patel, analysts at Emkay Global Financial Services.

Foreign investors have been pulling cash out of Indian equities for months, sending some of it to China (before getting burned there, too).

The budget playbook

With 2025 being a chill election year, you best believe that fiscal discipline will be king again. The Modi government is sticking to its 4.5% fiscal deficit target, meaning no reckless spending.

Tax tweaks? Maybe. Big giveaways? Unlikely, according to QuantEco Research economists led by Shubhada Rao.

Read more: India’s growth engine is sputtering. How do you deal with it?

So, what to bet on, you ask? Despite a likely cautious budget, infrastructure stocks are still a strong play.

Analysts like IRB Infrastructure, NCC, PNC Infratech, and Ultratech Cement as big winners. Banks like SBI, HDFC, and ICICI — which finance major projects — should benefit, too.

At this point, it’s the RBI and maybe state governments that might do the heavy lifting on growth, not Modi’s budget. But if something unexpected does drop, we’ll be covering it live on MONIIFY this Saturday.

Graphics by Alia Chughtai, Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com