Indian markets are in meltdown mode. The Nifty 50 is down more than 10%, and the Nifty Next 50 has declined by over 17%.

After nine straight years of gains, 2025 is off to a rough start for Indian stocks, and investor sentiment is at rock bottom.

But it’s not all doom and gloom we offer here. Some corners of the market — banks and pharma — are starting to flash “buy,” even when most others are screaming “stay away.”

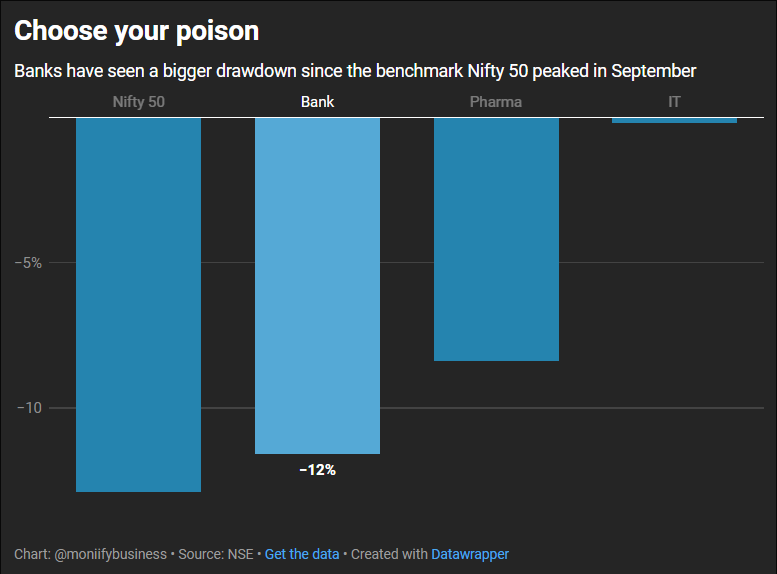

Banks in the lead

The Nifty Bank index jumped 1.4% on Tuesday morning, riding on the Reserve Bank of India’s $18 billion liquidity injection. Within the banking sector, large private players like Axis Bank and ICICI Bank stand out.

A major drag has been relentless selling by foreign institutional investors. If that slows down, likely in the near future, “private banks could emerge as the biggest beneficiaries,” Vinod Nair, head of research at Geojit Financial Services, tells MONIIFY.

Nair also highlights two other sectors worth watching: pharma for the short term and IT for the longer game as the AI business picks up.

Read more: S&P who? India’s retail army is supercharging its stock markets

Mixed signals

India’s IT sector, despite the global slowdown, has eked out a modest 1.3% gain since September.

Majors like Infosys, TCS, HCL Tech, and Wipro are trading slightly cheaper than the industry average P/E of 33. With Trump-era corporate tax cuts in the US potentially boosting IT spending, Indian firms could see a lift.

Pharma remains a short-term play, with major players like Cipla, Dr Reddy’s, and Aurobindo Pharma, trading at P/Es of 18-24 versus the industry average of 31.

But concerns are mounting. Nair points out that Indian pharma revenues are heavily tied to the US generic drug market, where pricing power is under pressure. Trump’s focus on cutting healthcare costs could squeeze margins further.

Read more: India’s small caps are 2025’s hot potatoes

The key

This week’s budget could decide if foreign investors come back. These investors are watching for reforms that can reignite growth after India’s GDP hit a third-quarter slowdown, with the government projecting just 6.4% growth for the full financial year ending 31 March 2025.

Corrections like this aren’t new — the Nifty 500 has seen three since 2015, lasting 609-800 days. This one’s just 126 days old. Valuations need to cool further before this dip becomes a buy.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com