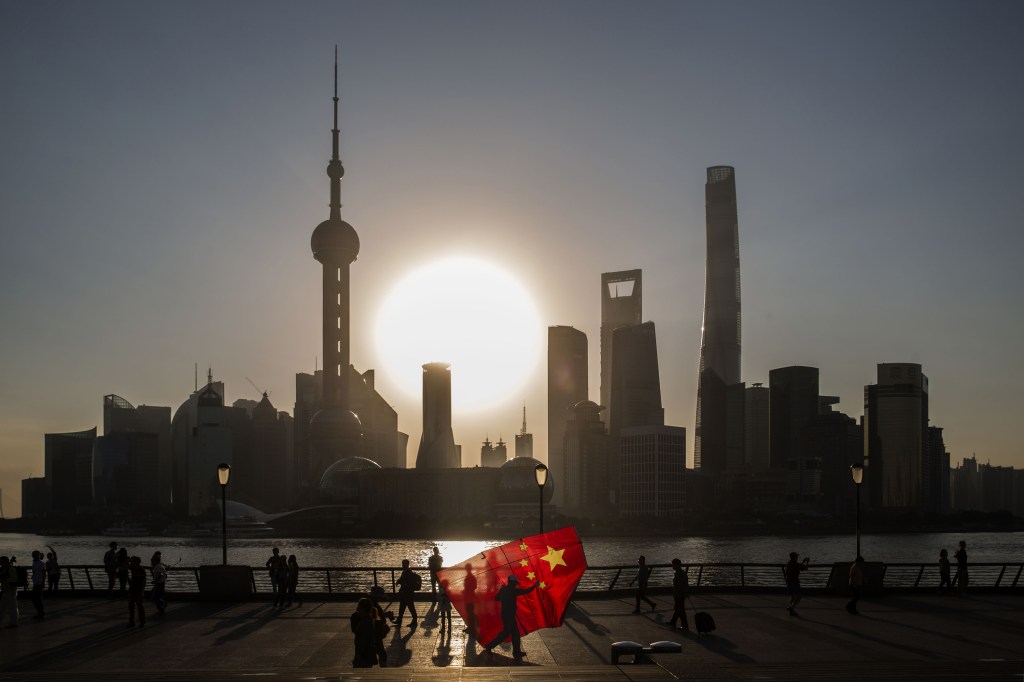

Trump 2.0 sounded like a nightmare for developing economies — especially China and Mexico — but the script’s changing fast.

From chest-thumping threats of 60% tariffs to a much less threatening 10% to a casual “I’d rather not”, US President Donald Trump’s softening stance on China is reshaping the landscape.

The MSCI EM Index has erased its year-to-date losses, and with DeepSeek turmoil battering US stocks, emerging markets are starting to look like the calmer port in the storm.

Read more: Are European stocks back? BofA says hold on

All bark, no bite?

The Trump presidency has created uncertainty, but similar to last time, “the bark may be worse than the bite,” Malcolm Dorson, head of emerging markets strategy at Global X ETFs, tells MONIIFY.

Adding to traders’ optimism is Trump’s “friendly” chat with Chinese President Xi Jinping, and hints of a trade deal. This has traders warming to EMs again after panic-selling earlier this year.

Goldman Sachs likes the setup for EMs in Asia, singling out China, Indonesia and the Philippines as top picks.

Younger, lower-income economies in the region are leading global growth, Goldman analysts led by Andrew Tilton and Kamakshya Trivedi say in a note. And a softer dollar — down 2% last week according to LSEG data — only sweetens the deal.

Read more: 2024’s political fireworks: South Africa survives, India wobbles, Mexico tanks

Bank of America analysts led by Mikhail Liluashvili agree, saying negative sentiment around EM currencies is likely peaking.

Normally, “universal consensus is a reliable contrarian indicator,” they say in a note, pointing to potential outperformance in February and March.

Don’t get too cozy, though. Trump-era flip-flops — like the back-and-forth over 25% tariffs for Colombia in a matter of hours — will keep markets jumpy.

Expect the dollar index to see “two-way movement” in the near term, as markets await Trump announcements, says HDFC Bank economist Sakshi Gupta. Overreactions to any news are likely, she adds.

Read more: Trump’s return is ushering in a real ‘golden age’

What’s the play?

Trump’s back-and-forth might be dizzying, but savvy traders know that volatility is where the money’s at.

Look at EM stocks, which haven’t regained the shine they had pre-2008, but they’re holding steady. Goldman Sachs predicts “moderate” returns for EM equities this year.

If you’re wary of Trump souring on China, Global X’s Emerging Markets ex-China ETF offers a way to play the field without betting on Beijing. For a direct play on EM currencies rebounding against the dollar, check out the WisdomTree Emerging Currency Strategy Fund.

Read more: Trump’s crypto promises have Asia’s Gen Z hooked

Feeling bold? Chinese equities are dirt cheap — trading at a 70% discount to US counterparts. BofA’s Michael Hartnett puts it nicely: Chinese stocks are insurance against bubble risks elsewhere.

So… yeah… whether it’s cheap Chinese stocks or a softer dollar lifting EM currencies, the opportunities are there — if you’ve got the stomach for it.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com