Shares of Adani Group companies, one of India’s largest conglomerates, surged after news broke that Hindenburg Research is calling it quits.

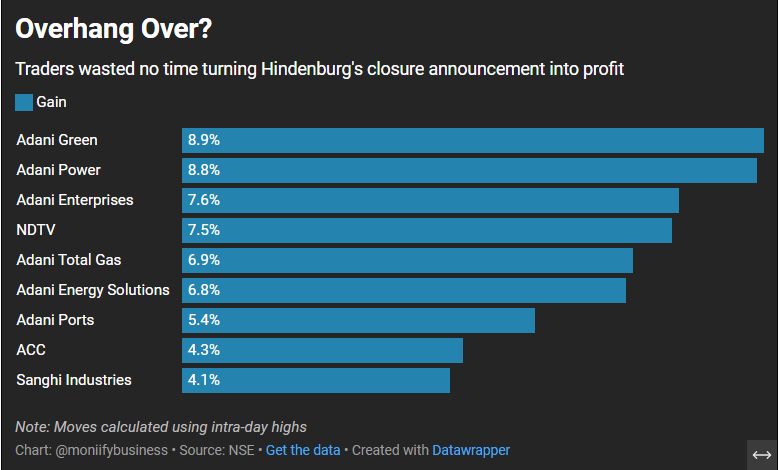

Adani Enterprises jumped by more than 7%, while Adani Green Energy and Adani Power posted gains nearing 9% before cooling off. In contrast, the broader Nifty 50 index barely moved, rising just 0.5%.

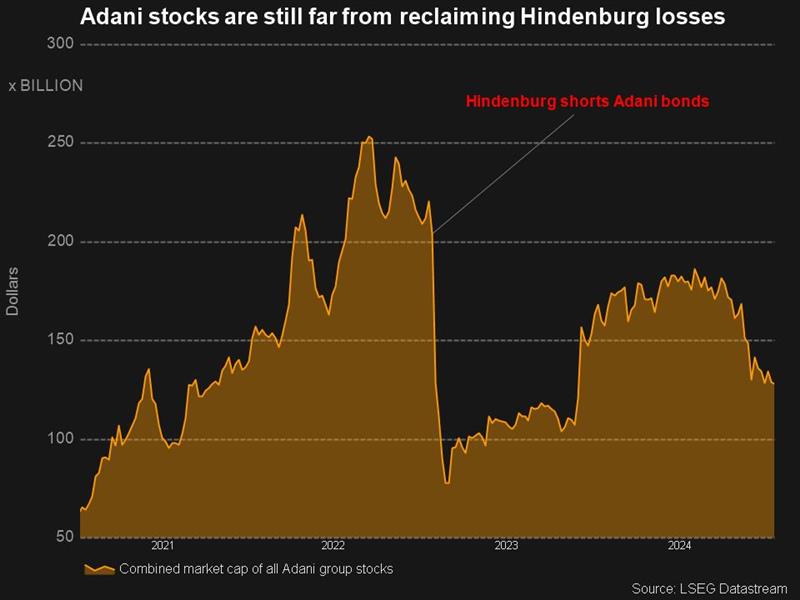

Hindenburg made waves in early 2023, accusing Adani Group of orchestrating “the largest con in corporate history.” The group’s stocks collectively lost more than $100 billion and it hasn’t been able to shake off a big chunk of those losses until today.

Though the conglomerate denied the claims, the allegations rocked investor confidence, especially with Hindenburg’s track record of solid calls that included taking down EV maker Nikola.

Read more: US charges India’s Adani in $250m bribery scheme

Now that Hindenburg is folding, Adani stocks seem to be breathing easier.

“The institution that gave Adani sleepless nights has now shut shop,” said Kranthi Bathini, director of equity strategy at WealthMills Securities. “This might be the reason” for the rally on 16 January.

A spokesperson for the Adani Group declined to comment on this story.

No one was safe

After taking its first swing at Adani, Hindenburg went for India’s securities regulator, too, claiming that Chairperson Madhabi Puri Buch had a conflict of interest during her Adani probe that she allegedly didn’t reveal to the authorities.

Hindenburg argued that SEBI was more focused on silencing whistleblowers than holding corporations accountable after the regulator slapped the short seller with a notice for allegedly using non-public information to build its positions.

Buch hit back, saying she’d disclosed everything before assuming her role and called Hindenburg’s claims “character assassination.” Last August, the regulator said it had completed all but one out of 24 investigations into the Adani Group.

Read more: #HotStox: Why Roblox is only for the brave

A breather, but…

Hindenburg’s closure might quieten some of the noise around Adani’s future, especially after Prime Minister Narendra Modi’s BJP secured a third term last June, giving the conglomerate a much-needed boost.

Chairperson Gautam Adani’s close ties to Modi remain a talking point, but the fallout from Hindenburg’s scathing report lingers: the group’s market cap is still $75 billion shy of its early 2023 peak.

In a farewell note, where he mentioned that no single issue was behind the decision to wind up the business, Hindenburg founder Nate Anderson says: “We shook some empires that we felt needed shaking.”

This story was updated throughout at 2pm.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com