Inflation is the headline act once again, with Wednesday’s CPI data set to shake up US stocks.

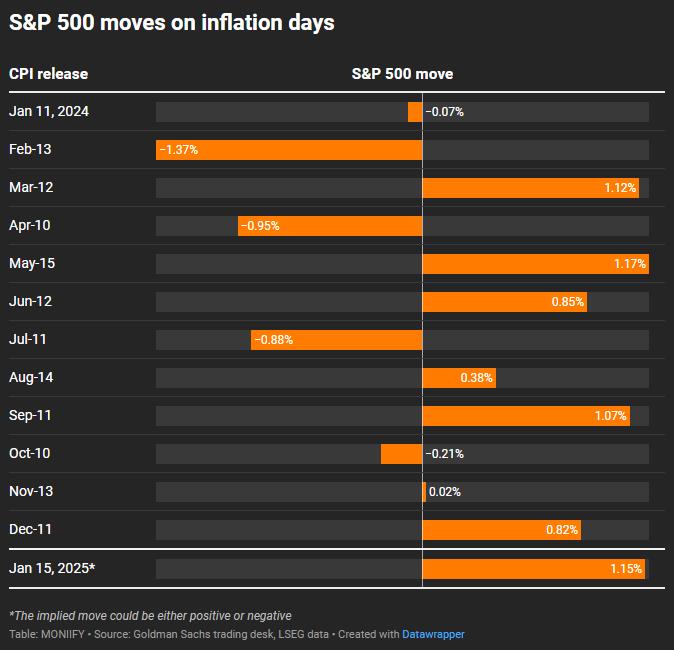

Goldman Sachs’ trading desk says that markets are pricing a big swing — about 1.15% — making it the most significant inflation day move since May. JPMorgan’s desk is calling it a “pivot data point.”

The market’s bracing for annual inflation to tick up while holding steady month on month, i.e. price pressures are sticking around.

This is all unfolding just as Donald Trump looms over the economy with a tariff-heavy playbook targeting China, Mexico, and Canada. Add in a rising VIX — nudging past 18 and edging towards the fear zone — and you’ve got a volatile mix heading into 2025.

Read more: Markets are serving chaos, and we’re just here for the plot twists 🎢🌊

Inflation reports took a backseat in late 2024, overshadowed by labor market jitters. But with jobs data on the rebound and Trump’s trade threats piling on, inflation is back in the driver’s seat.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com