The Donald Trump hype train has screeched to a halt.

After soaring 5.3% in a post-election glow, the S&P 500’s rally has fizzled. A month later, it’s barely hanging onto a 1% gain. Call it what you want, but this ain’t 2017’s market rager.

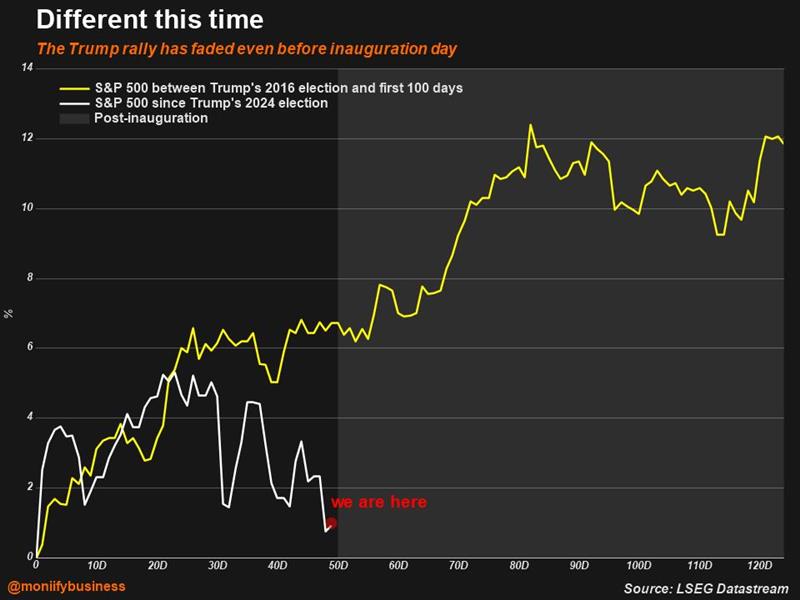

This is 2025, when investors are already feeling the hangover. Look at this chart:

The deadly duo

What’s killing the vibe? Trump and Elon Musk are in the driver’s seat, bringing new and fresh uncertainties almost every day. This duo appears focused on cutting government costs, scouting for countries to buy outright, and searching for tariffs to impose.

As Wall Street guru Ed Yardeni suggests, Trump is expected to issue numerous Executive Orders shortly after his inauguration, which could complicate rather than clarify the economic outlook.

Meanwhile, Trump’s team is eyeing monthly tariff hikes of 2% to 5%, adding another layer of confusion, Bloomberg reports. That strategy might be clever negotiation, or it might be four years of slow poison for the markets.

Coming to what else is haunting markets rn: this table neatly summarizes how the Trump rally has come to a screeching halt for the right reasons.

The smart play?

- The VIX is your best friend. The moment Trump drops a bomb, grab ETFs tracking the “fear gauge.”

- Once tariffs seem to be less alarming than expectations, chase these assets. This applies to Chinese stocks and emerging market currencies. These assets have already freaked and have priced in worst of the worst.

- With rates so high, just pump your money into money market funds such as Vanguard Federal Money Market Fund (VMFXX) and Fidelity Money Market Fund (SPRXX). No drama. Just steady returns.

Play it smart.

Could the excitement make a comeback after Trump takes office? 100%. But for now, this market is screaming for damage control more than champagne toasts.

Edited by Ankush Chibber. Graphics by Alia Chughtai. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com