What if we told you Nvidia was trading at early 2024 levels? Yes, before the 130%-plus gain.

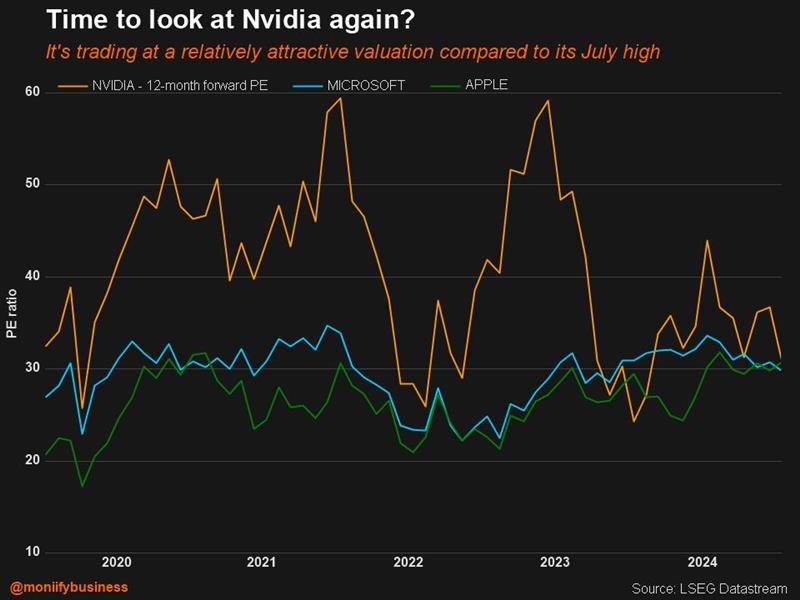

Going by the price-to-earnings ratio, a metric that’s used to figure out if a stock is expensive or cheap, the AI poster child has wiped out the entire premium it had built over fellow tech heavyweights like Microsoft and Apple.

Nvidia’s been going through a rough patch, and not for nothing. There are reports of delays to its new Blackwell chips, there’s rising competition and there’s the biggie: a US plan to impose new technology export restrictions that could seriously hamper its business.

Bears had their purple patch with an 11% drop from last week’s peak.

Read more: Is Nvidia switching to the slow lane?

But you can already hear the bulls arguing:

- Blackwell issues? Same tune, different day.

- Competition? Nice try, but Nvidia’s still miles ahead.

- AI chip curbs? US President Joe Biden’s term is almost up.

Bold reply

Yes, Biden’s last-minute push to expand AI chip export restrictions is a threat, but the ball will roll into Donald Trump’s court when he takes office on Monday.

Nvidia has already signaled its stance, slamming Biden’s proposed rules as government overreach and pinning its hopes on Trump to take a different tack.

“We look forward to a return to policies that strengthen American leadership, bolster our economy and preserve our competitive edge in AI and beyond,” it said. Ouch.

Read more: #HotStox: Nvidia FOMO? Look two blocks west

No one’s saying Nvidia’s heading back to the moon, but for those waiting to pounce on a bargain entry point, this might just be it. It’s a reset moment for an AI giant that’s still leading the pack.

What’s more, the company’s financials are in good shape. Revenue and profit are expected to grow by more than 50% next year, according to LSEG data, much faster than the forecasts for the other members of the Magnificent Seven club.

Analysts still love it

Bank of America still ranks Nvidia as a top pick, citing reassuring meetings with company executives about Blackwell production and “compelling” valuations, analysts led by Vivek Arya say in a note.

Morgan Stanley is on the same page.

The cherry on top? The stock currently has zero sell ratings and a consensus 12-month price target of $170.34, implying a 30% rise from current levels, according to LSEG data.

Read more: Nvidia who? The two stocks that matter more

Pro tip: BofA analysts, who have one of the highest price targets at $190, pointed to the upcoming quarterly earnings release on February 26 and Nvidia’s flagship GTC AI Conference on March 17 as the next big catalysts to keep an eye on.

While it’s easy to keep painting a rosy picture, IF Trump keeps the Biden administration’s plan to cap chip exports, things might play out differently.

Citi analysts just removed their bullish call on the stock for exactly that reason.

Still, seeing $NVDA trading at a bargain isn’t a daily sight. Maybe worth a shot?

Edited by Lin Noueihed. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com