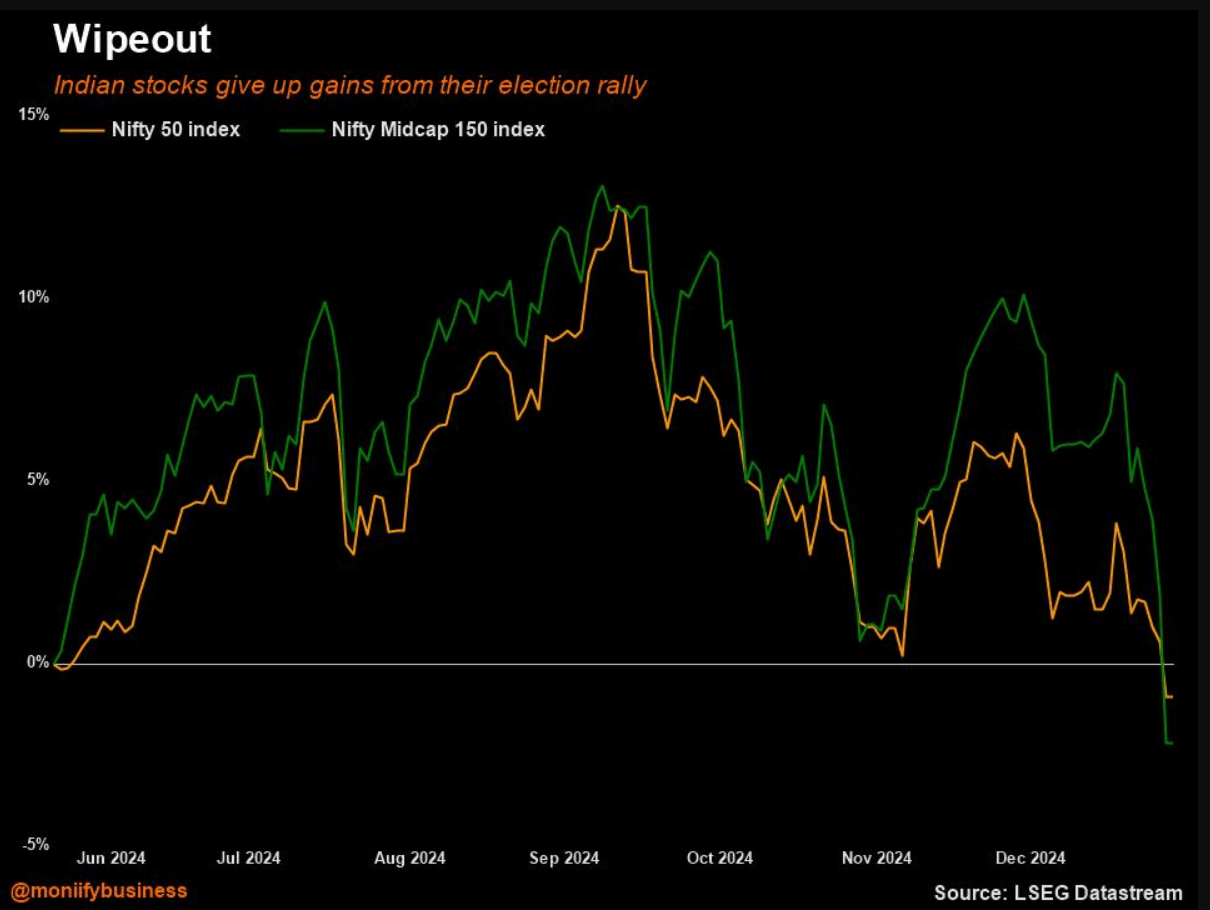

India’s stock market just took a massive U-turn, erasing all the gains it had built since the week of Prime Minister Narendra Modi’s election win in June. The celebration rally? Poof. Vanished into thin air.

And if you’re thinking: it’s time to buy the dip! Think again.

This isn’t your everyday market hiccup. The economy is grappling with rising oil prices, foreign outflows, and a rupee that’s weaker than your New Year’s resolutions.

India’s Nifty 50 has been riding the bull run for years. Even the pandemic, which upended markets globally, was little more than a speed bump on its decade-long ascent. But that’s changing as it’s become too expensive to own a piece of the India story. The price of Indian stocks is now 20 times earnings; that’s nearly 70% above emerging market peers. And when the economy is slowing down, that’s too much.

Read more: What does the rupee’s record low mean for your money?

Joanne Goh, senior investment strategist at DBS Bank, is cautious for that very reason.

And she’s not alone. Analysts from Kotak Institutional Equities are waving red flags, calling the value now on offer after the market dropped 10% from September highs “quite poor.” In other words, the market may look cheaper, but it’s still nowhere near a bargain.

But it’s not just these CFA-type financial analyses, things are gloomy at ground zero too. Inflation is high, rates ain’t coming down and elevated global bond yields are stealing the spotlight from stocks.

Read more: Going public, going wild: India’s 2024 IPO circus went off!

No RBI put

The Reserve Bank of India isn’t swooping in to save the day. Forex markets are volatile and there’s a lot of external uncertainty, so rate cuts are looking increasingly unlikely at the February Monetary Policy Committee, says Puneet Pal, head of fixed income at PGIM India Mutual Fund.

Emerging markets like India are losing their allure for foreign investors. Billions of dollars have poured out of Indian equities in recent months.

DBS’ Goh warns that caution is here to stay.

With global investors playing it safe as Trump embarks on his second term, India isn’t topping anyone’s must-buy list.

So can you MONIIFY this downturn?

Analysts at Kotak say stick to the big names. Large caps are the safest bet, while mid-cap, small-cap, and buzzy “narrative” stocks are likely to lose more as the froth fades and we’re left staring at the fundamentals.

For now, the best move might be to wait it out. After all, as history shows, the Indian market loves a comeback story. Just maybe not rn.

Read more: #GamePlan: The winners in India’s stalling bull run

Domestic power

Beyond praying for historic trends to play out (read our take from Monday), stock gurus aren’t really hopeful of 2025 fireworks.

Local institutions and retail investors have been the backbone of India’s stock market for years now, holding the line even when foreign money has flowed out. But slowing growth and rising prices are changing the calculation for them too.

For pandemic-era amateur traders who’ve only known a market that goes up, this could be the first encounter with prolonged losses.

How they respond to this downturn will be, as Kotak puts it, “interesting to see.”

Edited by Thyagaraju Adinarayan and Lin Noueihed. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com