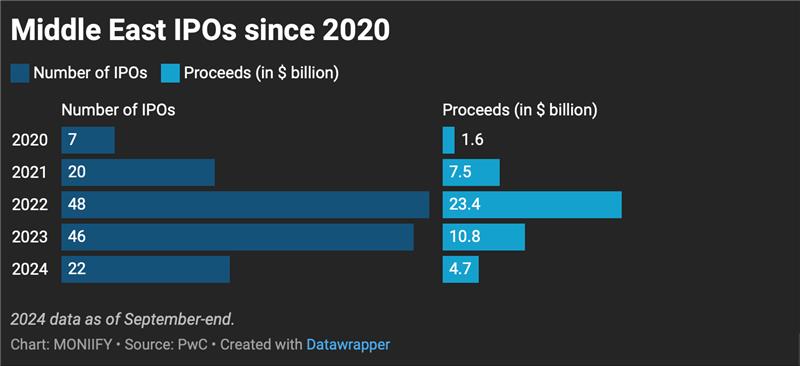

The Middle East IPO boom, once the toast of global investors, is cooling off. And 2025 might not bring the revival investors are hoping for.

2022 was the year the Gulf roared. IPO issuances peaked at a jaw-dropping $22 billion back then, with deals so hot you could fry an egg on them. Fast forward to today, and the market is struggling with (way) overvalued offerings and shrinking liquidity.

Even marquee names like Lulu Group and Talabat failed to impress last year, with lackluster debuts that left retail investors yearning for the halcyon days of 2022.

Akber Khan, the acting CEO of Doha-based Al Rayan Investment, doesn’t expect the old Gulf IPO buzz to make a comeback this year unless stakes in very large state-owned entities come to market.

Read more: Talabat’s cold start spells trouble for UAE’s IPO dreams

Sunny Saudi

If there’s one ray of hope, it’s Saudi Arabia. The kingdom is still flexing a robust pipeline that’s keeping investors intrigued.

Government-owned King Fahad International Airport, Saudia Airlines, Saudi Global Ports as well as some household names such as Alsulaiman Group for IKEA Saudi, Arabian Oud and Tabby are coming to market this year. Not bad at all.

But it remains to be seen whether Saudi’s poppin’ pipeline is enough to reignite investor excitement.

Just look at this chart:

Paying up

The biggest downer for Gulf IPOs is that they’re now VERY overpriced. Investing is expensive, even in Saudi Arabia, and doesn’t always leave buyers with enough upside to make sense.

For years, the hype and the big names were enough to draw investors even when the fundamentals weren’t great. Now, that’s just not enough.

Read more: Saudi is crushing the Middle East IPO race

The market has caught on to the fact that many shareholders use IPOs as an opportunity to exit at valuations that are higher than fair market value.

Add to the mix a liquidity crunch, and you’ve got the recipe for a slowdown. It’s a triple whammy:

- IPO hangover: the rush of deals in the last two years has drained cash reserves.

- High interest rates: why take risks in IPOs when you can make a solid 4% to 5% return with zero risk?

- Locked in: a lot of investor money is tied up in long-term real estate projects and other illiquid assets.

In other words, the Gulf’s IPO partygoers are nursing a financial hangover.

Go Middle in the Middle East

The big ones are pricey, and the small ones are risky. If you still want to buy a slice of the Middle East story, the sweet spot is the mid-sized IPOs with realistic valuation expectations.

Simply put, these companies don’t assume that their brand name alone will lure investors. So, they tend to be more disciplined –– and discipline resonates with today’s cautious investors.

Larger IPOs have faltered due to their overconfidence in the market’s appetite. For these companies, the lesson is clear: size and prestige alone are no longer enough to draw the big bucks, especially in the UAE.

The UAE currently has around 15 IPOs in the pipeline, but market participants are cautioning that not all of them will happen unless candidates are willing to trade in their flashy price tags.

So, all eyes are on Saudi Arabia (no pressure, yeah.) Can it keep the IPO engine humming, or is the Middle East’s golden era of IPOs already in the rearview mirror?

Edited by Lin Noueihed. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com