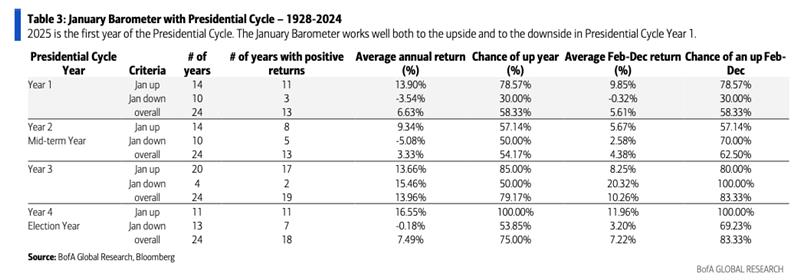

When January posts a gain in year one of a presidential cycle, the odds of a strong year for the S&P 500 skyrocket. It’s a cheat code.

Bank of America says there is a 79% probability that the market will end the year up, with an impressive average gain of 13.9%. That could push the index past 6,700.

But if January flops? Watch out. The odds flip, with a 70% chance of annual losses and an average return of -3.5%.

The S&P 500 has kicked off the new year on a choppy note, with the index barely up (+0.6%) right now. Today’s (10 January) jobs report will likely decide whether it breaks higher or stumbles. Volatility indicators suggest a stock swing of more than 1%.

But forget January and the year. How should you play today?

Read more: Big Tech’s S&P 500 stranglehold is becoming a problem

Goldman Sachs’ trading desk says if jobs come in way above the 160K consensus, bond yields will climb — and that’s bad news for stocks. If the number’s too low, growth fears will take over.

Heads or tails, the market might lose this round.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com