Donald Trump hasn’t even taken office yet, and the “animal spirits” are already kicking in.

But the free-for-all days of buy anything, watch it take off? Yeah, those are done.

Here’s why: the S&P 500 is sky-high, small caps are looking shaky with refinancing risks, and the Federal Reserve’s higher-for-longer rate mantra isn’t leaving anytime soon. So, where’s the sweet spot?

The middle child

“Meet me in the middle,” says Bank of America strategist Jill Hall. Mid-sized companies — undervalued and overlooked — are having their moment.

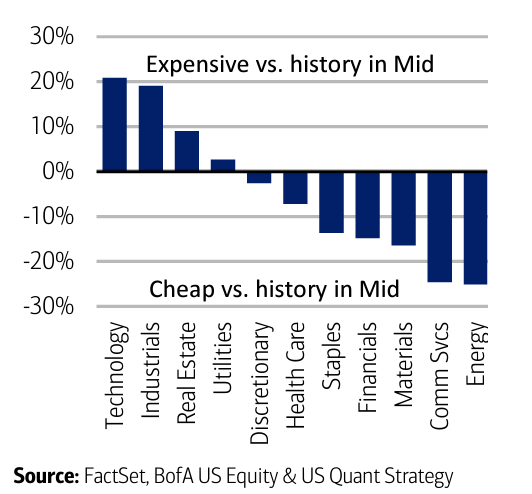

Listen to the Russell MidCap Index, which is signaling bargains: seven out of 11 sectors are trading below their historical averages since 1985.

The deepest discounts? Financials, energy, materials, and communications. BofA’s “buy-rated” favorites are heavy on financials with top picks like Aflac, Allstate, East West Bancorp, Bank of New York Mellon, and Nasdaq.

Bonus: mid-caps are prime M&A bait. With all the big players sitting on a cash mountain, expect more acquisition action soon, strategists say.

But not the youngest one?

Small businesses might be feeling themselves post-election — the NFIB’s Small Business Optimism Index just saw its biggest monthly spike in 50 years. Even the Russell 2000 is keeping pace with the S&P 500, both up ~6% since November.

But this trend might stick around only for the short term. Historically, small-caps shine right after an election (and that’s exactly what happened the last time Trump won in 2016)… then lose steam fast.

In 2017, 2018, and 2019, small caps underperformed large caps, according to BofA, and that’s exactly what could be served up in 2025.

Trump’s pro-business stance doesn’t guarantee a small-cap win either. Macro factors and profits matter more, and profits for small caps are currently recession-level bleak.

Plus, historically, small-caps have delivered better returns under Democratic administrations. Make of that what you will.

Trump’s proposed policies, on balance, may hurt small-cap profits more than help, BofA’s Hall adds.

And the big brother(s)?

The S&P 500 is skewed towards the Magnificent Seven.

The index’s top 10 stocks are trading at 37x forward earnings — that’s a 68% markup compared to the rest of the market. Tesla, meanwhile, is on its own financial planet.

With valuations for large caps bloated and small caps risky, mid-caps have it going for them. Undervalued, M&A-ready, and sitting in sectors poised to rebound, mid-caps might just be the play.