Can you imagine life without Google? (Sorry, ChatGPT — you’re not there yet!)

Google, or rather Alphabet, isn’t just the search engine overlord.

It’s YouTube, Waymo, Google Cloud, and now, Willow — the quantum chip flexing enough computational muscle to crunch in under five minutes what a supercomputer would take 10 septillion years to handle. (Yeah, that’s 24 zeros.)

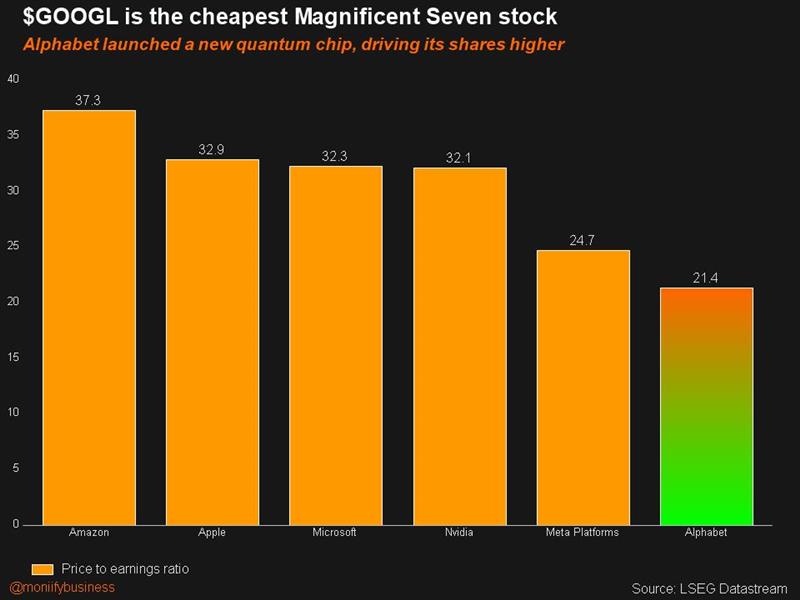

But here’s the wild bit: Alphabet’s stock performance doesn’t scream tech powerhouse. Compared to its Magnificent Seven peers, Alphabet looks like a bargain bin pick.

Alphabet is the cheapest stock among the Magnificent Seven, with a forward price-to-earnings ratio of 21x. That’s discount aisle stuff compared to Apple’s 33x and Microsoft’s 32x, and even cheaper than Meta’s 25x.

It was even cheaper before the Willow announcement. The stock is up nearly 9% over the past week.

Blame regulators who have gone after it for monopolizing search, but any issues on that front are already priced into the stock. These fights have dragged on for years, but a Trump-led deregulation wave could give Big Tech a green light to bulk up further.

Cheap as chips

Despite its troubles, Alphabet is growing faster than most American companies, pays dividends, trades at a discount and boasts assets that BofA analysts say are “underappreciated” in the stock — Waymo, its self-driving car division, and Google Cloud.

BofA has a 12-month price target of $210 for Alphabet (it trades @ $190 now), and the bank is not alone. Consensus suggests nearly a 9.4% increase from current levels, and not a single analyst out of the 58 covering the stock gives it a “sell” rating.

It also sees the company’s quantum tech as a turning point.

While the commercial induction may still be years away, Willow could drastically speed up the training capabilities of Google’s foundational models, BofA’s Justin Post and Nitin Bansal say in a note.

Translation: The potentially massive future benefits of this tech = Alphabet’s stock could be a steal now!

No chinks?

Alphabet also owns Google DeepMind, the creator behind Gemini AI. Then there’s YouTube, estimated to be worth $500 billion plus — $100 billion more than Netflix, according to Needham & Co. In short, it’s got a lot going for it.

But there are a few risks to be mindful of when it comes to this giant.

Google Search revenue is slowing — 43% growth in 2021 dropped to 8% in 2023. AI competitors eating into its search dominance could be trouble, and any antitrust ruling forcing it to sell Chrome would be a gut punch.

But even with those caveats, at these valuations, Alphabet’s long-term upside might be too good to ignore. The stock’s cheap today. Once the quantum hype turns into commercial reality, don’t expect it to stay that way.