While global markets sputtered post 5 August, Dubai decided to flex.

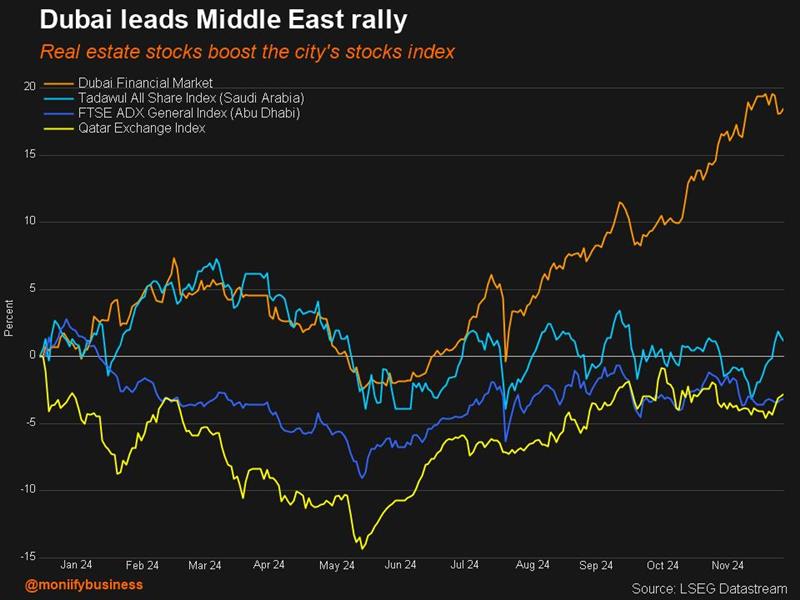

Its stock market has roared back with a 19% recovery, leaving Gulf neighbors like Abu Dhabi, Saudi Arabia, and Qatar eating dust with 3%-5% gains. (yawn). Even the S&P 500 couldn’t keep up.

And this isn’t just a one-off. Dubai’s been the star of 2024, with a 19% gain year-to-date while others in the Gulf are either treading water or have dipped into the red.

The crown jewel of the Dubai market? Emaar Development. The real estate firm under Emaar Properties has risen 66% this year, easily outpacing Dubai as well as the S&P 500 (27%).

And despite a booming real estate market (thanks to the relaxation of Covid-era lockdowns and an influx of Russian cash after the Ukraine war), its trading at a bargain! Its forward price-to-earnings ratio is just 7x — way cheaper than 2022’s 10.5x, 2014’s 23x or 2006’s 20x.

Dark clouds?

Before you pile in, consider this.

The index is still far from its 2006 peak, reached during a boom-bust cycle that ended with the global financial crisis. Right now, it’s sitting closer to its 2014 highs, which came during a real estate boom that fizzled when oil prices crashed.

Here’s the wildcard: What happens if Donald Trump pulls a rabbit out of his hat and ends the Ukraine war? A Russian cash exodus could hit Dubai’s property market and its red-hot stock index hard.

This is a show you’ll want to keep watching.