Meme lord Elon Musk is tripping on 420 again, and Tesla’s social media team is right there with him. Yes, the stock hit $420 (pre-stock split levels), and the stonks jokes practically write themselves.

This isn’t Musk’s first 420 rodeo — it’s the infamous number from his “funding secured” tweet back in 2018 when he claimed he’d take Tesla private. Spoiler: it didn’t happen. But here we are, years later, and the meme — a nod to the weed culture’s favorite number — is alive and driving retail investors crazy.

Tesla didn’t respond to requests for a comment but here’s what Musk tweeted back then, or is it X’d now?

Musk math

We ran the math: Musk’s $450 billion net worth is higher than the market value of 483 S&P 500 companies. He could buy all listed Mexican companies or the 46 smallest companies on the S&P, and still have change for a few Dogecoins.

Right, enjoyed the fun bits and Musk’s glorious meme god moments? Let’s get serious and talk about things that matter when you invest!

- The stock is trading at 131 times earnings, the most expensive member of the Nasdaq 100 –– the home of Magnificent 7s.

- BYD, THE top-selling EV maker, trades at 17x and has a revenue growth forecast of 26% for 2024.

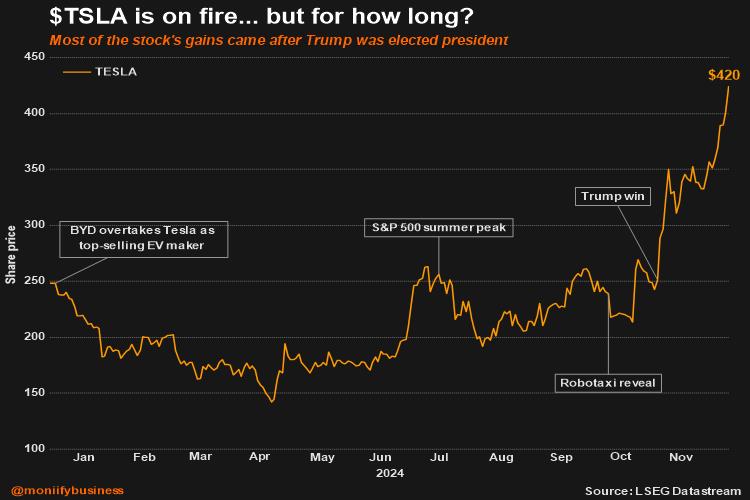

Tesla’s been on a tear, up a jaw-dropping 70% in one year, with most of the gains crammed into the past two months. Trump’s election has given the stock a boost, with speculation about self-driving policies and Musk cozying up to the President-elect.

But there’s a catch: The president-elect hinted at slashing the $7,500 EV tax credit. Musk seems to be okay with it as head of D.O.G.E., but investors? Perhaps not so much.

And about that promised $25K “cheap” Tesla? It’s still MIA. Musk now calls cheap cars for humans “pointless.”

Deutsche Bank says a $30K “Model Q” could launch in 2025, priced under $30K with subsidies — or $37,499 if that tax credit vanishes. But don’t forget Tesla’s reputation for overpromising and underdelivering on timelines.

Finding solid reasons to back this insane run feels like trying to catch smoke.

So… keep driving?

Tesla’s stock has already blown past every analyst’s estimate for next year, without any major fundamental changes. Morgan Stanley points out that the hurdles for self-driving commercialization — tech, permits, state laws — are still massive.

Sure, the new administration might revisit self-driving car policies, but even then, Tesla’s got mountains to climb.

And yet, there seems to be questionable enthusiasm from many quarters.

“I am not chasing the stock, but my feeling is that the momentum is firmly on the upside and would not be surprised to see another 20-25% upside crazy as it sounds,” says Keith Temperton, sales trader at Forte Securities.

Here’s the thing: this insane run feels more like retail FOMO and Trump buzz than real, sustainable growth.

Before the Trump bump, the stock was dragging through a pretty lackluster year. There’s a lot of future things going on for this stock, but these could be just moonshot ambitions that will not see the light of day.

Betting on Tesla now? It’s like betting on the next meme. Fun, maybe. Smart? Not so sure.