You are not imagining it: Your average café coffee is getting absurdly expensive.

Coffee prices have shot up around 80% this year on supply concerns, but don’t just blame your addiction to lattes. EVERYTHING is feeling pricier these days. 😖

Inflation, that persistent economic villain, could be staging a dramatic comeback. And it’s coming for the Fed’s carefully laid plans — just as it’s started cutting rates.

The Trump effect

Donald Trump is set to impose tariffs and slash corporate taxes.

Pair that with an economy growing at a solid 2.8% and estimated to accelerate to 3.3% in the fourth quarter of this year, according to the Atlanta Fed, and you’ve got the recipe for overheated markets.

Torsten Slok, Apollo Global’s chief economist, warns that the economy is strong, and the incoming administration may “add additional tailwinds” that force Fed to RAISE interest rates in 2025, reversing its cutting spree.

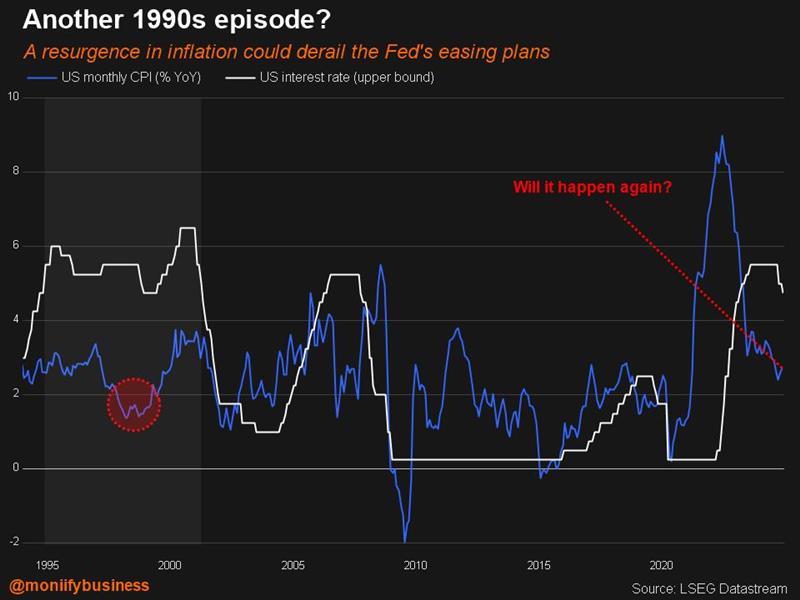

Deja Vu?

Well, this is not unheard of. Back in the mid-1990s, the Fed cut rates a few times only to turn around and raise them again when inflation roared back.

November’s data tells a similar story: Core consumer inflation — excluding the volatile food and energy categories — climbed 0.3% for a fourth consecutive month, marking a 3.3% increase compared to the same period last year.

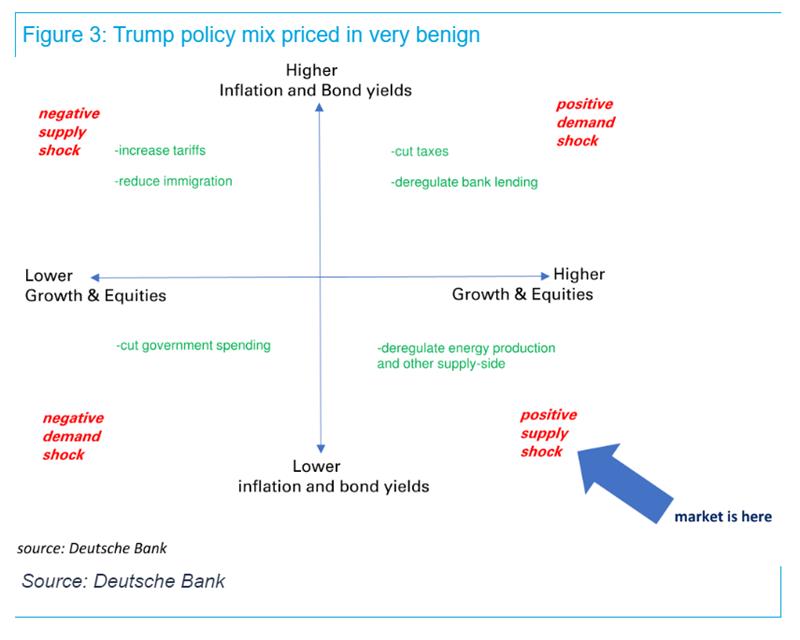

Deutsche Bank says signals point to the trend worsening:

- Housing inflation: Forward-looking indicators are ticking up. Why does this matter? Well, housing accounts for about 45% of core inflation.

- Immigration slowdown: Immigration boosts labor supply, keeping wages and limit inflation in check. But in Trump’s shadow, inflows are already slowing, creating the wrong type of supply shock.

The immigration “positive supply shock” was key to letting the Fed play it cool with rate cuts this year. A reversal, combined with housing inflation, might do just the opposite, the German lender says.

JPMorgan’s chief economist, Bruce Kasman, agrees, warning that tariffs on China rising and reduced immigration could fan inflation broadly “and slow central bank easing.”

Here’s a diagram from Deutsche Bank to put it in perspective:

Someone wins?

If rates go up, financials could come out on top. Higher interest rates are a classic win for banks, boosting their interest income, and Trump’s more relaxed regulatory stance could sweeten the deal.

The Financial Select Sector SPDR Fund is already up more than 20% in the past six months, and Morgan Stanley is all in — jumping on the bandwagon back in October, upgrading the sector and labeling it as a cyclical sweet spot.

So yeah, for banks, inflation coming back is all milk and honey. For the rest of us? Better get used to even pricier coffees.

ChatGPT corner