The UAE’s days as a sunny tax haven will end in January when it raises its corporate tax for multinational businesses.

The tax will hit 15% for multinational companies with a global turnover of $793 million or more, the ministry of finance says, putting it in line with global norms.

The top up marks the end of an era for the Gulf state, which carved out its niche as THE Middle East business hub by attracting international firms with zero taxation and other sweeteners. But YES, the country’s famous free zones, a key draw for global businesses, will stay tax free. (Phew!)

Why the shift?

The transition began last year when the UAE rolled out a 9% corporate tax. The increase aligns with the OECD’s push to create a global tax baseline of 15% to ensure fairer competition. It’s also part of the UAE’s effort to clean up its image as a magnet for dirty money. It was removed from the Financial Action Taskforce’s grey list this year after it took steps to combat money laundering and get in line with international norms.

So, tax is good?

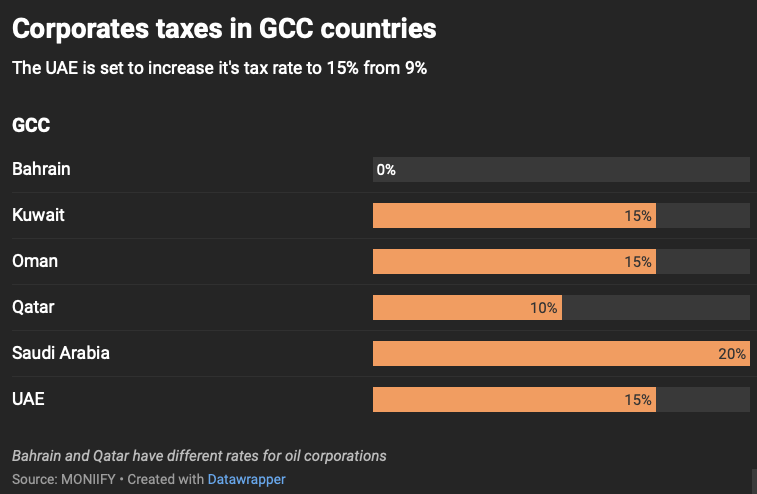

New taxes are rarely welcomed by investors but Bal Krishen, chairman and CEO of Century Financial, tells MONIIFY, that the UAE remains attractive compared to places like the UK or even Saudi Arabia, where businesses pay 25% and 20%.

There’s still no tax on personal income in the UAE and the country has a attracted a record number of millionaires since Covid. But rising property prices and a major talent crunch are already becoming real hurdles for business, says Benny Thomas, CFO of AA AL Moosa Enterprises. The corporate tax will only add to those costs.

On the talent front, the UAE is facing a major shortage, particularly in management and leadership roles, with 27% of businesses struggling to find good candidates.

To soften the blow, the UAE will offer tax breaks to companies that hire senior executives in core growth sectors or invest in innovation.

Sure, the UAE is no longer the tax-free paradise it once was, but it’s now playing the long game. The real question is how businesses and investors will adapt.