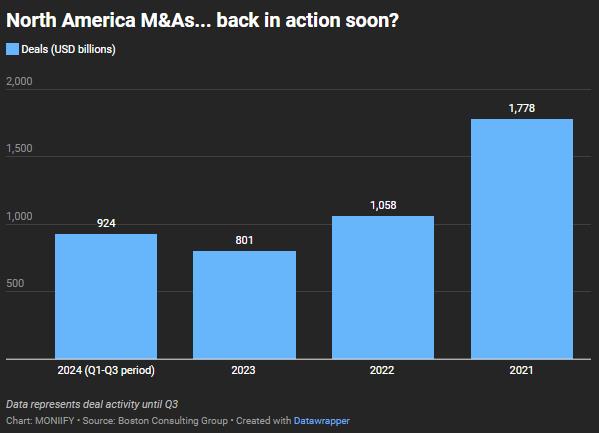

Wall Street’s buzzing with dealmaking fever, betting big that the president-elect will swing open the gates for mergers and acquisitions after years of Joe Biden’s stricter stance.

Since Donald Trump’s win last month, banking giants like Morgan Stanley, JP Morgan, and Bank of America have climbed over 10%. Goldman Sachs led the pack with a 17% surge, fueled by optimism that cash-flush corporate America is ready to spend big to make deals happen.

Corporate America is gearing up for a dealmaking bonanza, Frank Aquila, a senior M&A partner at law firm Sullivan & Cromwell, tells MONIIFY. “Clients are much more optimistic.”

Goldman expects 20% more M&As in 2025, after an anticipated 15% decline this year.

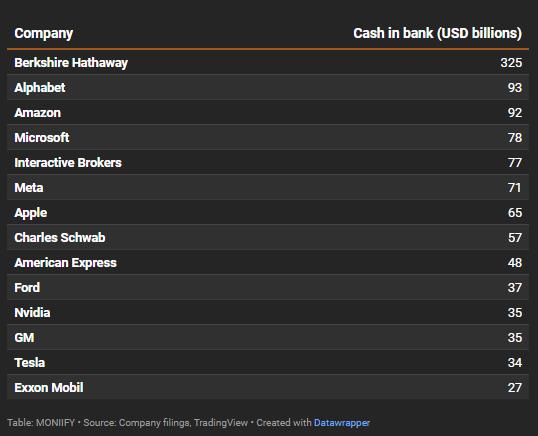

Sitting on $$$

Major players in tech and auto are sitting on more than $1 trillion in cash. The top 15 well-capitalized US public firms alone with $1 trillion are primed enough to put that money to work — and a chunk of that is marked for M&As.

Under Joe Biden’s government, deals like Microsoft’s $70 billion acquisition of Activision, took two years to close. In 2016, Microsoft took only six months to close its next biggest deal – the purchase of LinkedIn.

Where to look

The big picture SCREAMS dealmaking. Financial services, energy, tech and healthcare are key sectors that’ll see higher M&As, Michael Ashley Schulman, chief investment officer at US-based advisor Running Point Capital, tells MONIIFY.

- Financials: Bank M&A activity has historically been 50% higher under Republican administrations. Expect a flurry of deals in this sector.

- Biotech: Big pharma’s appetite for smaller acquisitions remains strong, driven by exclusivity challenges and lower rates.

Software may cool off as companies pivot toward AI and data, according to BofA strategists Jill Hall and Nicolas Woods, but that doesn’t mean Big Tech is staying idle.

Deals to watch

IBM’s bid to buy HashiCorp and HPE’s pitch for Juniper Networks are among deals investors will be watching going forward, while analysts expect less antitrust scrutiny for the pending Capital One and Discover merger.

For investors, it’s not just about watching from the sidelines — it’s about finding the right plays to ride the wave.

Pro tip: Small-cap targets tend to pop after deals are announced, but even large-cap acquirers have seen record one-day gains this year, according to BofA.

Translation? There is more than one way to cash in. 😉

ChatGPT corner