Borrow, buy Bitcoin, repeat. That’s pretty much the strategy in MicroStrategy.

Not bad for a stock that’s gone up almost 500% this year. It’s beaten even the OG crypto itself, as well as meme king Dogecoin. 🤑🚀

Crazily enough, Michael Saylor, MicroStrategy’s chairman and former CEO, is a long-time bull and now expects Bitcoin to hit $13 MILLION a coin by 2045.

(What would $MSTR be valued at by then? Forget 2045, it’s already bloated in 2024!)

The stock has closely followed Bitcoin’s performance for years, until it broke out with wild gains earlier this year. No one’s quite sure what sparked the surge, but one thing’s clear: $MSTR isn’t for the faint-hearted.

MicroStrategy currently holds roughly $40 billion worth of Bitcoin – or nearly 2% of the world’s supply! That explains why the cryptocurrency is half of its hefty $85 billion valuation.

The other half

Now, a $45 billion-plus valuation for a biz that brings in just $500 million a year is screaming BUBBLE all the way. Remember, it’s only a “software company” like its homepage suggests.

In fact, it’s inspired a copycat! Drawing inspiration from $MSTR, Bitcoin miner MARA Holding started its own borrow-and-load-up-on-Bitcoin hustle. This is proper FOMO at play, as MARA’s stock has barely risen this year.

In its latest round, MARA raised $850 million in bond markets on Wednesday just before Bitcoin smashed past $100K.

But before you pop that bubbly, here are some sobering numbers about $MSTR. Sorry.

Volatility central

- It’s crazy volatile. MicroStrategy’s 90-day volatility sits at 101%, higher than Nvidia’s 56% and Tesla’s 72%. And, honestly, it’s starting to look more volatile than Bitcoin itself.

- No upside. The stock is running so fast that it’s already zoomed past analysts’ 12-month price targets. Analysts now see no gain coming over the next 12 months, according to LSEG data.

- It’s scary. Bitcoin’s 130% gain = 500% jump for $MSTR this year, so imagine how ugly a downside could be?

Besides, with plenty of Bitcoin ETFs around, why bother with a big fat Bitcoin knockoff?

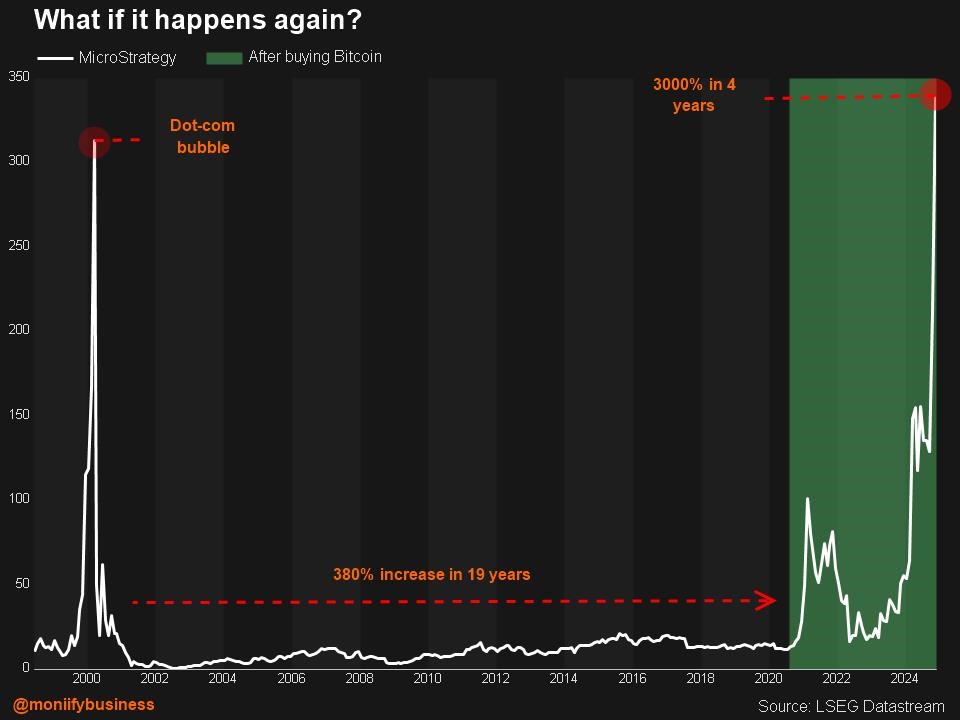

Finally, check this chart out:

Even short-seller Citron Research, which used to be one of the biggest bulls on the stock, flagged last month that $MSTR has completely detached from Bitcoin fundamentals.

“While Citron remains bullish on Bitcoin, we’ve hedged with a short $MSTR position,” the short-seller said in a post on X. MicroStrategy didn’t respond to a request for comment on Citron’s statement.

But… but… there are so many MicroStrategy bulls out there. It’s the third-most traded stock on Interactive Brokers after Nvidia and Tesla.

And some analysts see it gaining even more. San Francisco-based brokerage BTIG sees MicroStrategy’s stock hitting $570 from $406 now. It cites “ease of access, downside protection, access to capital markets” among factors that make $MSTR the “best vehicle to gain exposure to Bitcoin.”

The brokerage didn’t respond to a request for clarification on how these factors specifically set MicroStrategy apart from other Bitcoin-related investments.

One more thing: it’s now potentially joining the prestigious Nasdaq 100 index, home to the who’s who of Big Tech: Apple, Microsoft and Nvidia.

All that being said, can you stomach the wild ride?