It’s going to be a lot more expensive to do business in Indonesia, after a 1-2 combo of a higher minimum wage and a looming tax hike.

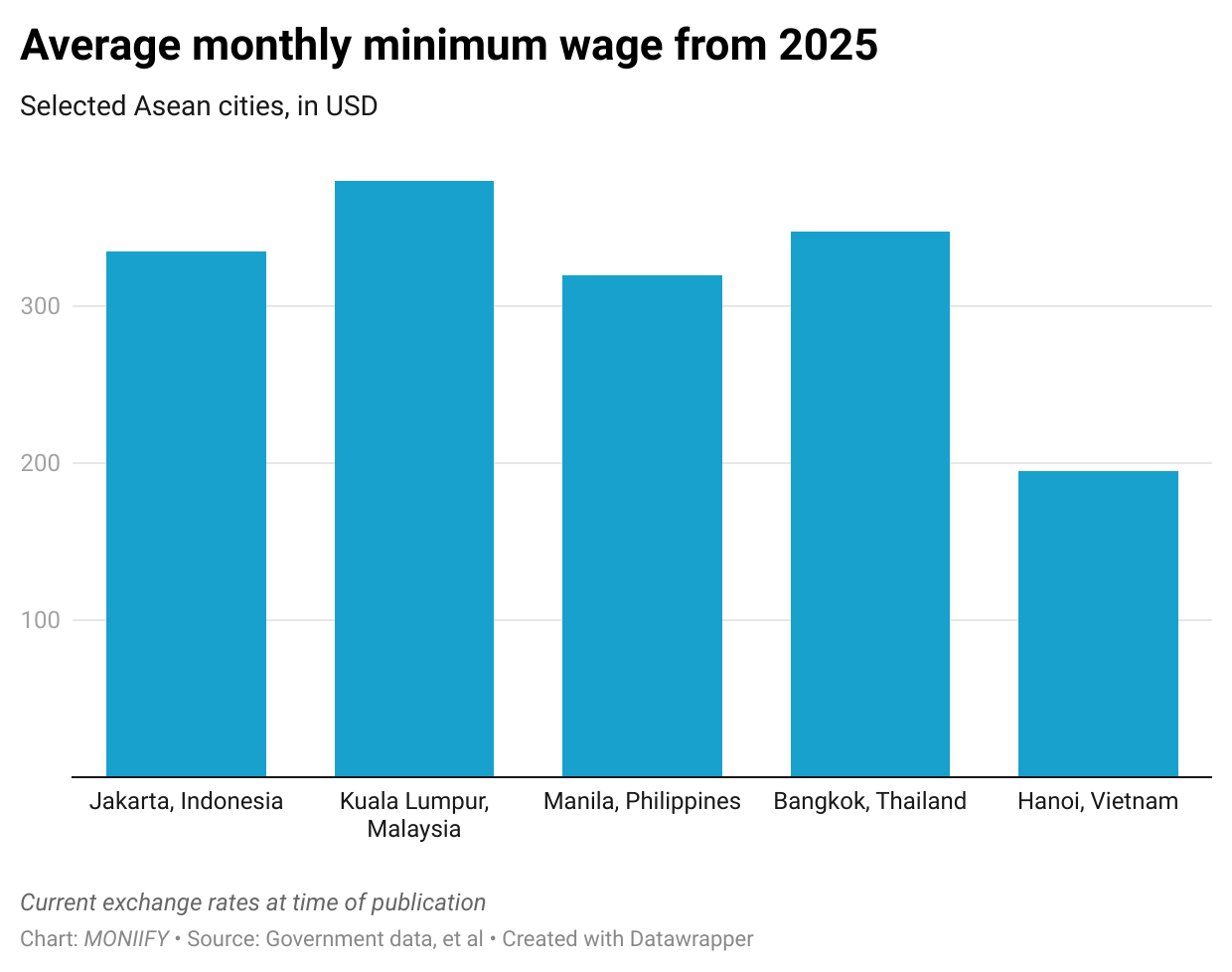

The country is raising its minimum wage by 6.5% in 2025, making it one of the region’s priciest labor markets. And if that’s not enough, a planned VAT increase to 12% — on par with the Philippines and the highest in Southeast Asia — could be next.

Talk about timing

The VAT hike comes at a tough time. Josua Pardede, chief economist at Permata Bank, tells MONIIFY that it could hammer middle- and low-income households. This in turn could further weaken purchasing power in the economy.

Adding to the chaos, the government hasn’t confirmed if the VAT hike will even happen.

That lack of clarity, paired with Indonesia’s constantly shifting wage rules (five changes in 10 years according to the Indonesian Employers Association, or Apindo), is confusing local businesses while scaring off big-name investors keen to move on from China and Vietnam.

Case in point: Apple. The US tech giant has a bigger investment footprint in Thailand and Vietnam, even though both markets are smaller COMBINED than Indonesia.

Read More: China’s Oppo is teaching Apple and Google a lesson about Indonesia

Bigger costs, bigger problems

Beyond wages, doing business in Indonesia is no bargain. Energy, logistics, and loans are pricier here than in other ASEAN countries. Employers are now facing tougher rules:

- Paying salaries before unsecured creditors in bankruptcy cases.

- Local hires prioritized unless specialized skills are needed.

- Termination headaches, with wages paid during disputes, no matter how long it takes.

That’s all good for workers but it’s complicated for businesses to manage while remaining competitive.

“Imagine, we have allocated a budget to pay for workers’ wages, suddenly the formula changes towards the end of the year,” Bob Azam, head of manpower affairs at Apindo, tells MONIIFY.

The formula Azam’s talking about refers to how minimum wages are calculated, which is complicated and differs by region.

According to government data, the average monthly minimum wage stands at 3.1 million rupiah ($195) in Indonesia. But in the capital, Jakarta, it’s about 5 million rupiah ($314).

Mounting worries

Indonesia’s regulatory hurdles have cost it momentum “for the umpteenth time,” says Azam.

And the data shows it: foreign direct investment into the country stood at 1.9% of GDP, compared to Vietnam’s 4.4% and 3.6% in Malaysia, according to OECD’s latest report on the nation last week.

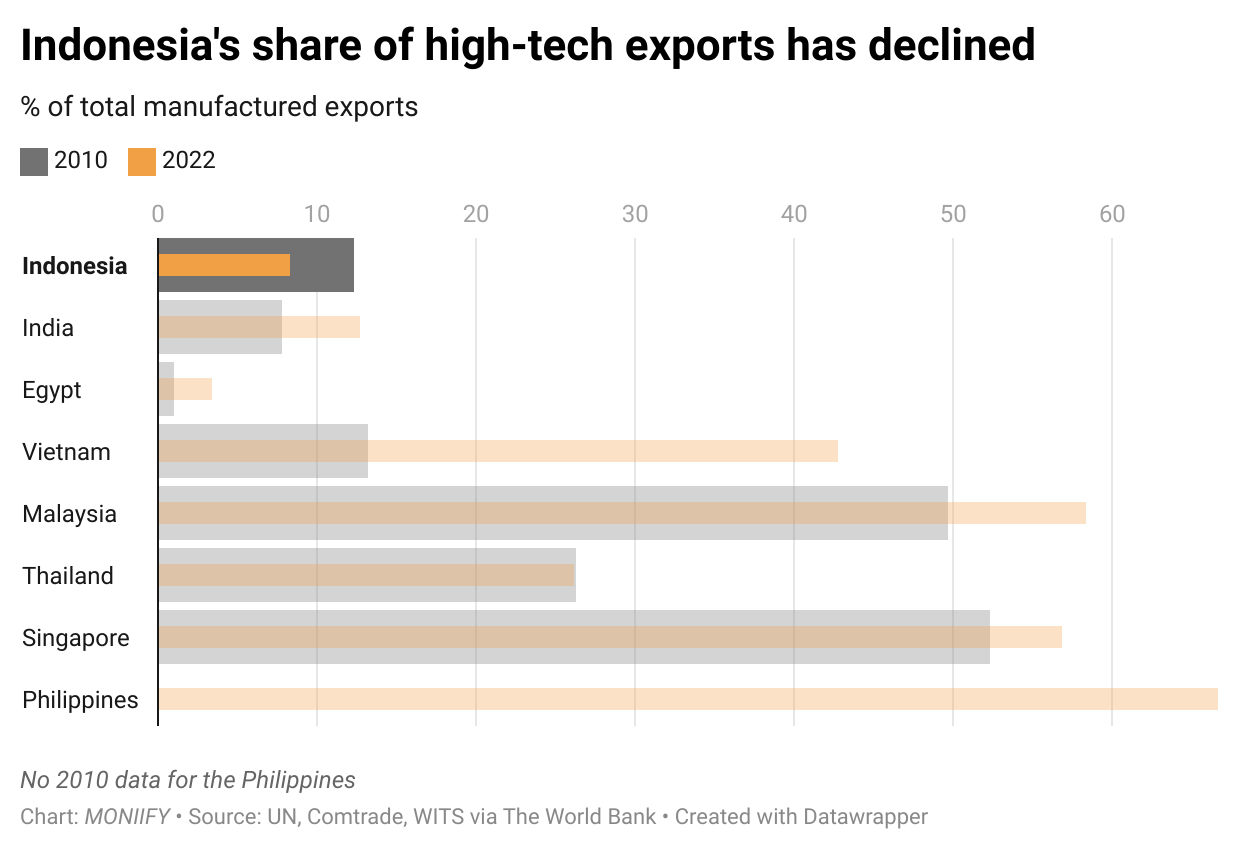

Between 2010 and 2022, Indonesia’s high-tech manufactured exports SHRUNK from 12.3% to 8.3%. While its neighbors like Malaysia and Vietnam grew their share of medium- and high-tech manufactured exports.

Read more: Fraud and Failure: Indonesia’s P2P sector takes another hit

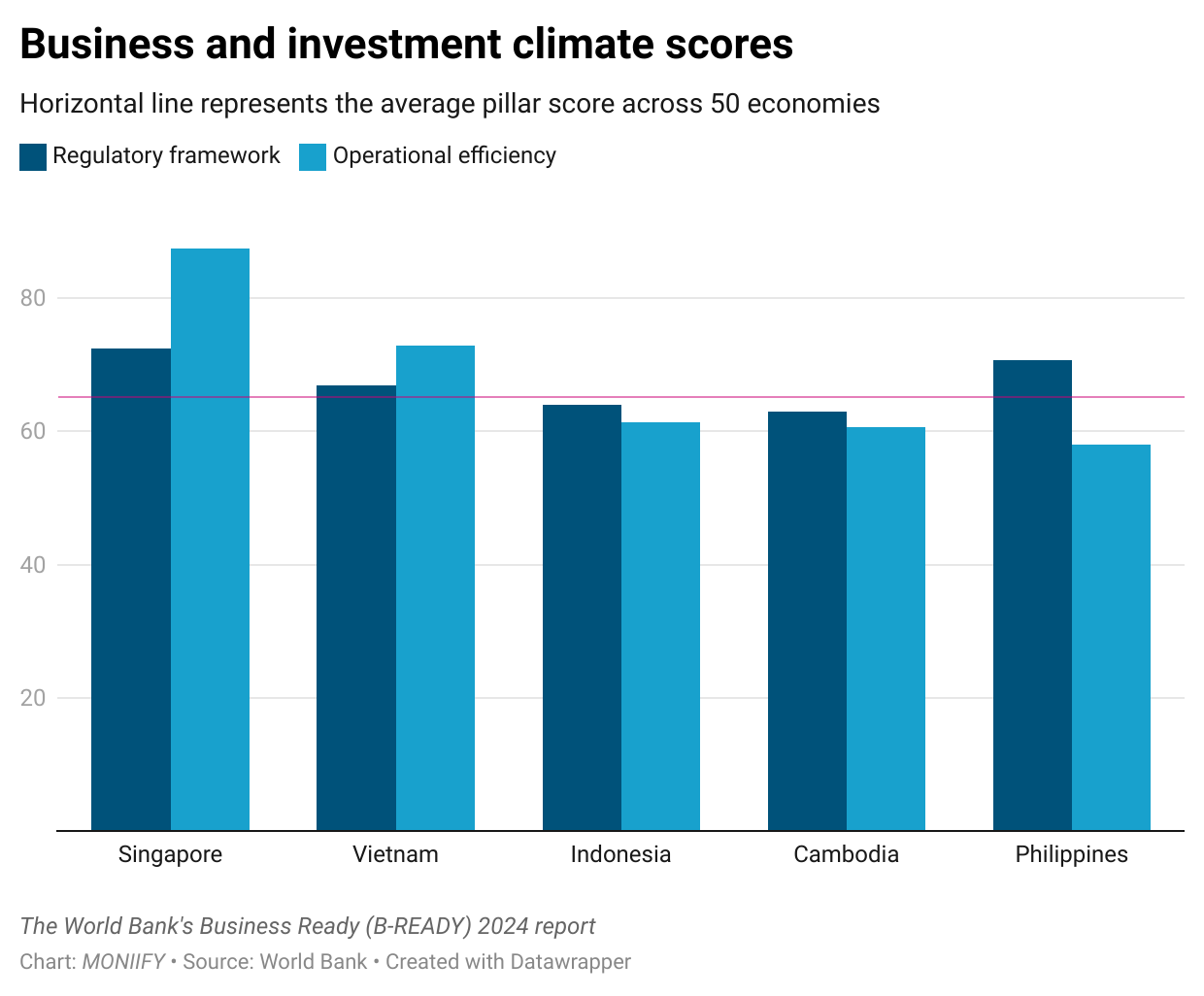

The World Bank’s 2024 Business Ready report ranks Indonesia’s public service efficiency below the average of 50 surveyed economies.

The country’s already suffering from relatively low participation in globalization, according to the OECD.

The VAT hike, if enforced, could shave 0.3%-0.4% off GDP growth, analysts predict. Household consumption drives over half of Indonesia’s GDP, so higher taxes mean weaker spending.

The stock market’s already feeling the heat, dropping 10% from September’s peak, with the rupiah sliding alongside it.

Silver lining?

If you’re looking for that sliver of sunshine – businesses operating consumer staples (think food and household products) are less likely to be impacted as demand, historically, does not dip even in the face of tax hikes.

The extra $$$ that the tax hike brings in could also go a long way towards President Prabowo’s public health and energy infrastructure projects.

The downstream impact of these projects finally living and thriving could be a net positive for local businesses.