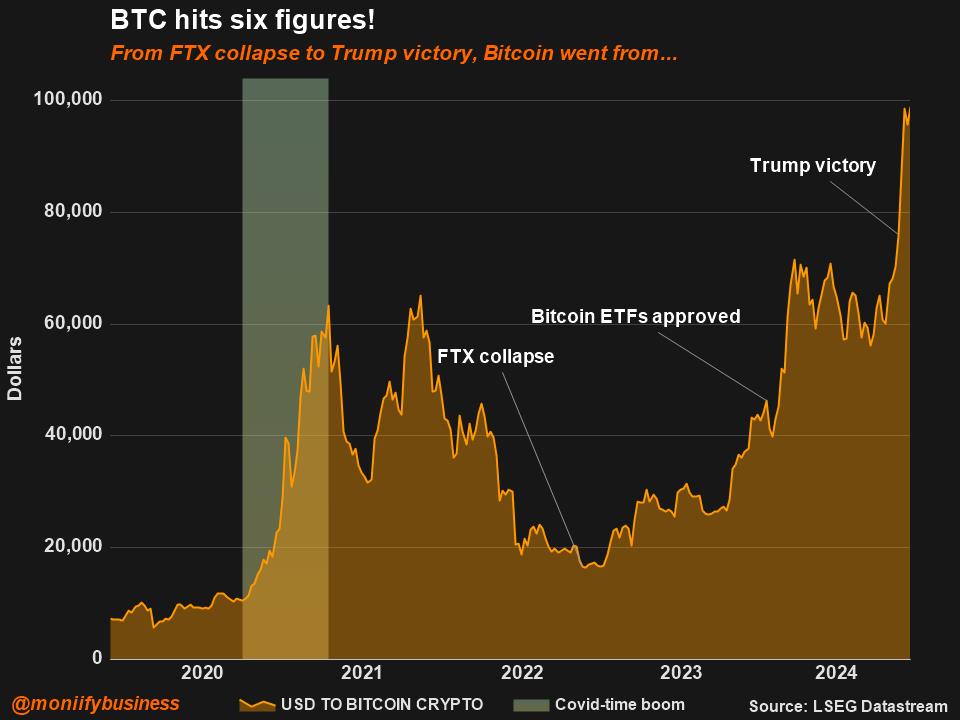

Bitcoin smashed through the long-awaited $100K milestone Thursday, hours after Donald Trump officially named the pro-crypto Paul Atkins to lead the SEC.

The OG crypto isn’t just back — it’s flexing hard. Bitcoin has breached $103K pushing its market cap beyond a record $2 trillion, with analysts calling this the start of a new bullish cycle.

It’s not riding solo, either. Ether and Dogecoin have joined the rally, climbing 5% in the past 24 hours, per CoinGecko.

“If you bought $100 of Bitcoin when Coinbase launched in June 2012, it’d be worth $1,500,000 today,” Coinbase CEO Brian Armstrong flexed on X. “Bitcoin is the best-performing asset of the last 12 years, and its still early days. Happy Bitcoin $100K day.”

Jet, set, go!

Bitcoin’s ascent was set in motion last month as Trump’s election win sparked buying mania, sending the cryptocurrency surging past its $73K resistance level from March.

Read More: Inside Trump’s push to make crypto great again

It flirted with six figures for weeks as the president-elect doubled down on promises to introduce crypto-friendly regulations and make the US the capital of crypto again.

It finally broke through as he started delivering: replacing the crypto industry’s nemesis Gary Gensler as head of the US market regulator with the pro-crypto Atkins.

Atkins has been co-chairman of the Digital Chamber’s Token Alliance since 2017. He’s long argued for the SEC to be more accommodating in order to keep crypto activity stateside.

That stands in contrast to Gensler, who dragged giants like Binance and Coinbase into court, and drove some crypto business offshore.

The nomination won praise from crypto enthusiasts, including in Congress.

Pro-crypto Senator Cynthia Lummis called Atkins’ nomination a huge win for financial innovation and celebrated Bitcoin’s six-figure milestone with a simple message: “Don’t stop believing.”

Hester Pierce, aka “Crypto Mom,” who stood up to Gensler as an SEC commissioner, also threw her weight behind Atkins: “I cannot think of a better person for the job.”

Read more: Australia’s crypto cop: Figure it out, mate!

A new world

The latest developments signal a broader change in the crypto landscape. The US has long dominated the global economy through the dollar, which still acts as the world’s main reserve and trading currency.

Trump wants to use crypto to lead the digital economy in the same way, creating a Bitcoin strategic reserve and enacting laws that will encourage the sector in the US.

But more legitimacy for crypto in the world’s biggest economy will almost certainly translate into more legitimacy worldwide.

“Many called it a fad or predicted its demise,” Sumit Gupta, co-founder of India’s CoinDCX, said. “This milestone is a testament to Bitcoin’s resilience and adoption.”

Adoption is already on the rise. The introduction of Bitcoin and Ether ETFs this year has helped transform what was once seen as a volatile outside bet into an essential part of many investment portfolios.

Bitget’s head analyst, Ryan Lee, thinks Bitcoin will reach new highs at $150K and even $200K by next year.

“The market’s measured reaction suggests there may still be room for growth,” he told MONIIFY.