Tech stocks are sitting pretty. Maybe too pretty for your pocket.

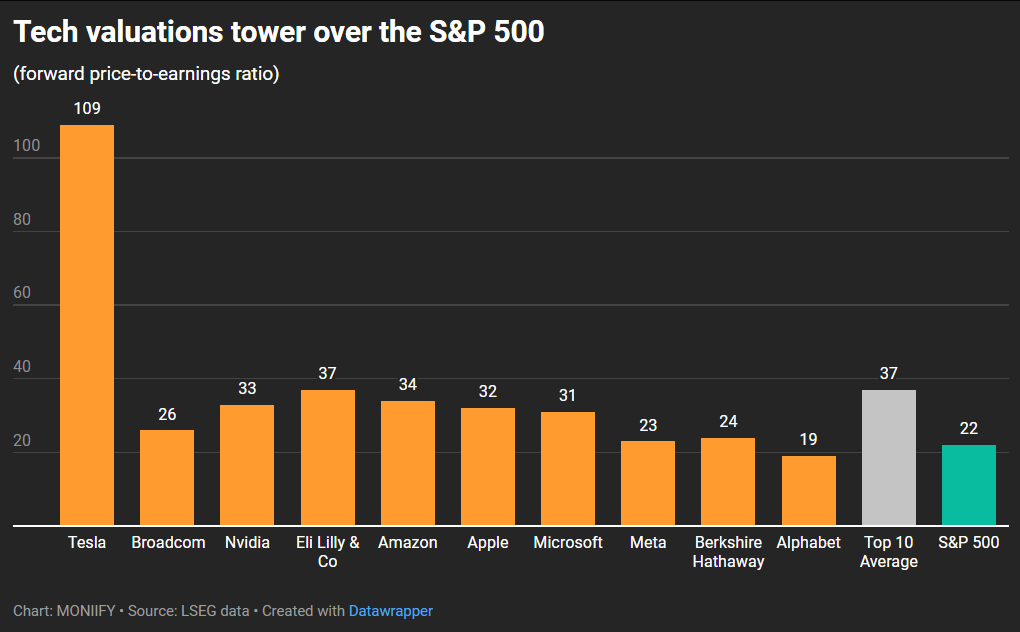

The S&P 500’s top 10 stocks by market cap — mostly tech giants — have an average forward price-to-earnings ratio of 37 times. That’s 68% more expensive than the S&P 500. Yet traders are still splurging the $$$ and… still making money.

Sure, they have enough cash and solid profit growth, but it’s hard to justify those valuations when AI spending hasn’t yet paid off and third-quarter earnings were a bit of a letdown.

Then there’s Tesla. It’s in a galaxy of its own. At a whopping 109x valuation, it’s the priciest tech stock on the board, pumped up by recent hype around the Trump-Musk bromance after a mostly flat year.

That bromance is really something, but it doesn’t do much for Tesla’s fundamentals. Third-quarter deliveries and earnings weren’t terrible, but they’re nowhere near what’s needed to justify this kind of valuation. Read the MONIIFY take on Tesla here.

By comparison, Alphabet looks like a steal, with a forward P/E ratio of 19x. The government’s antitrust case is weighing on Alphabet, which may be forced to spin off Google Chrome, but its self-driving car company Waymo, could turn into a new growth shot.

Is it us or is the line between cars and computers getting blurred?